AUTOMATIC STAY AND BANKRUPTCY FAQs

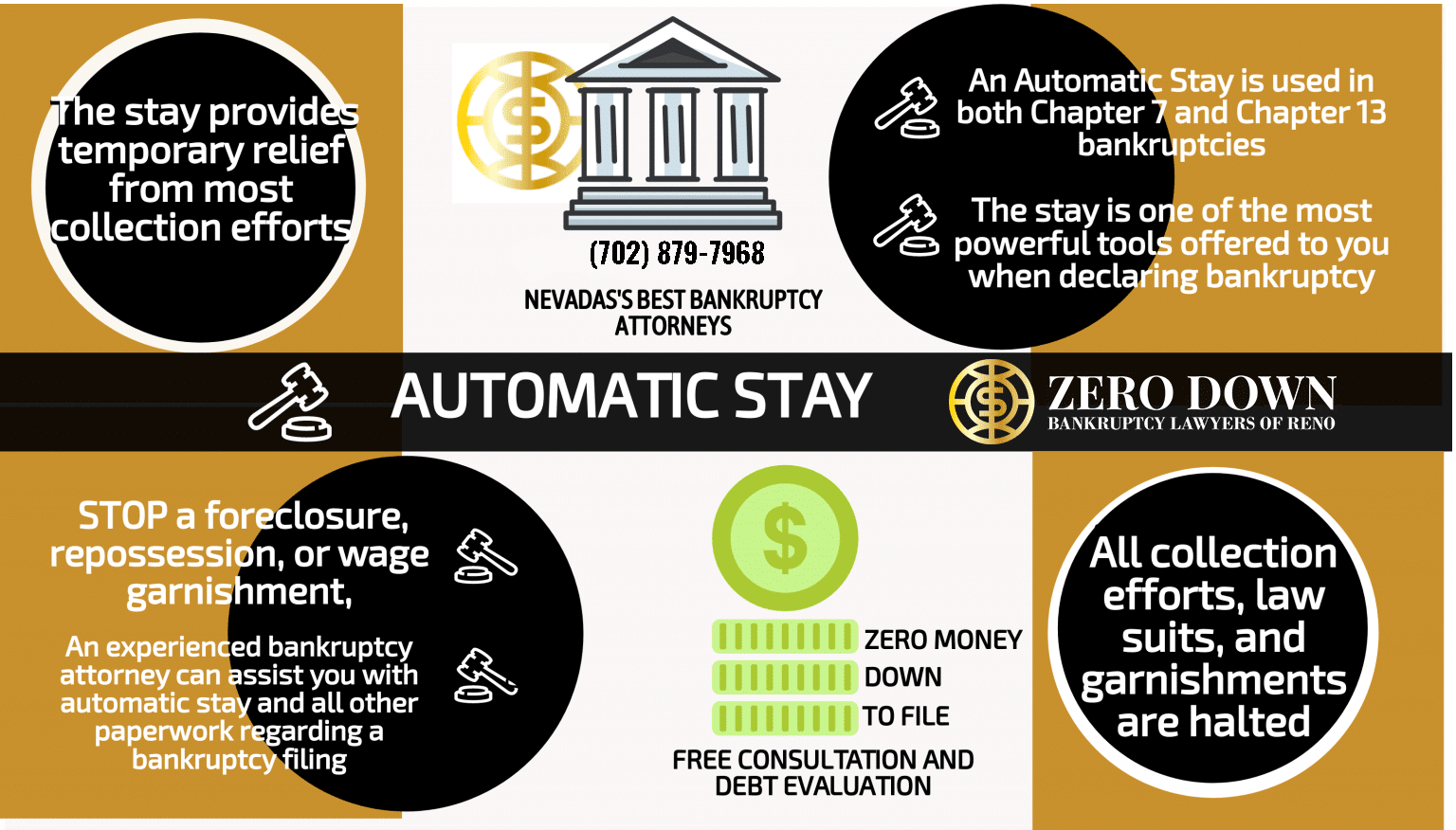

The automatic stay is one of the most important functions of filing a bankruptcy case. The automatic stay is the protection that you receive from the US bankruptcy court from your creditors. The automatic stay, “stays” or “freezes” most creditor action when a bankruptcy case is filed. The stay happens as soon as a bankruptcy is filed, this includes Chapter 7, Chapter 11, and Chapter 13 bankruptcy filings in Nevada.

For example. If your wages were about to be garnished, and you filed a bankruptcy case before the creditor had a chance to attach your pay, the filing of the bankruptcy case would stop the garnishment. If your house was going into foreclosure, and you filed a bankruptcy case before the foreclosure date, the filing of the bankruptcy case would stop the foreclosure. Another example; assume your car payment was so far behind that it was about to get repossessed. If you file a bankruptcy case before the car is taken back by the creditor, the filing of the case would stop any repossession action by the creditor.

All You Need To Know About The Automatic Stay

The automatic stay in bankruptcy is very powerful. Not only can creditors not take action such as foreclosure or repossession, but creditors cannot attempt to collect from you while there is a pending bankruptcy case. It is essential to bankruptcy and there are severe penalties for creditors who violate the automatic stay.